FY 1999

| INFORMATIONAL CIRCULAR NO. 99-A-001 | (Supersedes 98-A-001, 98-A-007, and 98-A-012) |

|---|

| DATE: | June 18, 1998 | ||

|---|---|---|---|

| SUBJECT: | Private Vehicle Mileage | ||

| EFFECTIVE DATE: | July 1, 1998 | ||

| A & R CONTACT: | Audit Services Team - | Randy Kennedy | (785) 296-2125 |

| Leroy Charbonneau | (785) 296-2255 | ||

| Shirley Gilchrist | (785) 296-2882 | ||

| Jo Ann Remp | (785) 296-2277 | ||

| APPROVAL: | |||

| SUMMARY: | Private Vehicle Mileage Reimbursement Rates Effective July 1, 1998 | ||

|

|

|||

K.A.R. 1-18-1a has been amended to increase the reimbursement rates for privately owned vehicles for travel taking place on or after July 1, 1998. The amended rates are:

16¢ per mile for privately owned motorcycle

32¢ per mile for privately owned automobile

44¢ per mile for privately owned airplane

44¢ per mile for privately owned specially equipped vehicle for the physically disabled

Examples of specially equipped vehicles include, but are not limited to, those equipped with hand controls or lift devices. Other situations may be evaluated on a case-by-case basis if you are uncertain about the applicability of this rate.

Please note that the provision to reimburse mileage at the central motor pool rate for compact cars remains in effect for any state employee choosing to use a privately owned automobile, when a state-owned or leased vehicle is available for use. For FY 1999, this rate remains at 18¢ per mile as established by Central Motor Pool. The complete schedule of motor pool rates will be distributed to all state agencies in a memorandum from the Central Motor Pool Director.

SAM:JR

| INFORMATIONAL CIRCULAR NO. 99-A-002 | (Supersedes 98-A-002) |

|---|

| DATE: | June 18, 1998 | ||

|---|---|---|---|

| SUBJECT: | Subsistence Rates | ||

| EFFECTIVE DATE: | July 1, 1998 | ||

| A & R CONTACT: | Audit Services Team - | Randy Kennedy | (785) 296-2125 |

| Leroy Charbonneau | (785) 296-2255 | ||

| Shirley Gilchrist | (785) 296-2882 | ||

| Jo Ann Remp | (785) 296-2277 | ||

| APPROVAL: | |||

| SUMMARY: | Revised Meal Allowance and Lodging Rates Effective July 1, 1998. Taxes associated with lodging are no longer included when applying the lodging limits to the daily rate. | ||

|

|

|||

Kansas Administrative Regulation 1-16-18 has been amended, effective July 1, 1998, to increase the subsistence allowance rates, as well as to reflect a broadened definition of Washington, D.C., and New York, New York as "out-of-state special designated high-cost geographic areas." The revised rates are:

Meal Allowance:

| In-State | $ 7.00 per quarter-day |

|---|---|

| In-state, designated high-cost geographic area | $ 7.25 per quarter-day |

| Out-of-state, regular | $ 7.25 per quarter-day |

| Out-of-state, designated high-cost geographic area | $ 7.50 per quarter-day |

| Out-of-state, special designated high-cost geographic areas | $10.50 per quarter-day |

| International travel | $10.50 per quarter-day or actual expenses not to exceed $76 per day |

Reduced Meals Allowance:

If the cost of meals is included within the cost of registration fees or other fees and charges paid by the agency or supplied without cost by another party, the meals allowance should be reduced as follows:

| Breakfast | Lunch | Dinner | |

|---|---|---|---|

| In-state | $6.50 | $7.50 | $14.00 |

| In-state, designated high-cost geographic area | $7.00 | $8.00 | $14.00 |

| Out-of-state, regular | $7.00 | $8.00 | $14.00 |

| Out-of-state, designated high-cost geographic area | $7.00 | $8.00 | $15.00 |

| Out-of-state, special designated high-cost geographic areas | $10.00 | $11.00 | $21.00 |

Lodging Expense Limitations:

| In-State | $54.00 |

|---|---|

| In-state, designated high-cost geographic area | $68.00 |

| Out-of-state, regular | $81.00 |

| Out-of-state, designated high-cost geographic area | $118.00 |

| Out-of-state, special designated high-cost geographic areas | $129.00 |

| International travel | Actual |

| Conference lodging qualified under K.A.R. 1-16-18a(e) | Actual |

K.S.A. 75-3207a(e) provides that the daily lodging expense limitations established above may be exceeded by the lesser of either: (1) an additional 50% of the applicable lodging expense limitation, or (2) the actual lodging expense incurred.

Lodging Taxes

The regulation has been amended to allow application of the lodging limits to the lodging rate before taxes. Thus, the amount reimbursed or paid for lodging expenses may exceed the established lodging limitation by as much as the amount of associated taxes.

Border Cities

In accordance with K.A.R. 1-16-18(3), the director of accounts and reports may designate any city in a state bordering or near Kansas as a "border city" and reimburse meal allowance and lodging at in-state rates. A revised border city listing is included with Informational Circular 99-A-004.

SAM:JR

| INFORMATIONAL CIRCULAR NO. 99-A-003 | (Supersedes Informational Circular No. 1332) |

|---|

| DATE: | June 18, 1998 | ||

|---|---|---|---|

| SUBJECT: | High Cost Geographic Areas and Conference Lodging | ||

| EFFECTIVE DATE: | July 1, 1998 | ||

| A & R CONTACT: | Audit Services Team - | Randy Kennedy | (785) 296-2125 |

| Leroy Charbonneau | (785) 296-2255 | ||

| Shirley Gilchrist | (785) 296-2882 | ||

| Jo Ann Remp | (785) 296-2277 | ||

| APPROVAL: | |||

| SUMMARY: | Revised high-cost geographic areas and provisions for payment of the actual cost of conference-related lodging effective July 1, 1998. | ||

|

|

|||

Effective July 1, 1998, Kansas Administrative Regulation 1-16-18a has been amended. Additions and deletions were made to the list of high-cost geographic areas throughout. Please note the changes for the Washington D.C. and New York City areas identified under "Out-of-State Special Designated High-Cost Geographic Areas."

The boundaries of designated high-cost geographic areas include all locations within the corporate limits of the cities listed, unless otherwise specified. The designated high-cost geographic areas are:

In-State High-Cost Geographic Areas

Kansas City, including all locations within Johnson and Wyandotte Counties

Manhattan, including all locations within Riley County

Topeka, including all locations within Shawnee County

Wichita, including all locations within Sedgwick County

Out-of-State High-Cost Geographic Areas

Afton, Oklahoma, including Shangri-La Resort

Anchorage, Alaska

Aspen, Colorado, including all locations within Pitkin County

Atlanta, Georgia

Atlantic City, New Jersey, including all locations within Atlantic County

Austin, Texas

Avon and Beaver Creek, Colorado

Baltimore, Maryland

Baltimore, Maryland

Barrow, Alaska

Boca Raton, Florida

Boston, Massachusetts, including all locations within Suffolk County

Cambridge, Massachusetts

Carmel, California

Chicago, Illinois, including all locations within Du Page, Lake, and Cook Counties

Cleveland, Ohio

Dallas/Fort Worth, Texas

Denver, Colorado

Edison, New Jersey, including all locations within Middlesex County

Fairbanks, Alaska

Fort Meyers and Sanibel Island, Florida, including all locations within Lee County

Hershey, Pennsylvania

Hilton Head Island, South Carolina, including all locations within Beaufort County

Honolulu, Oahu, Hawaii, including all locations on the Island of Oahu

Houston, Texas

Indianapolis, Indiana

Juneau, Alaska

Kaanapali Beach, Maui, Hawaii

Kailau-Kona, Hawaii

Kaunakakai, Molokai, Hawaii

Keystone, Colorado, including all locations within Summitt County

King of Prussia, Pennsylvania

Kodiak, Alaska

Lake Buena Vista, Florida

Los Angeles, California, including all locations within Los Angeles, Kern, Orange, and Ventura Counties

Miami, Florida

Minneapolis and St. Paul, Minnesota, including all locations within Hennepin, Ramsey, and Anoka Counties

Monterey, California, including all locations within Monterey County

Nashville, Tennessee

Newark, New Jersey, including all locations within Bergen, Essex, Hudson, Passaic, and Union Counties

New Orleans, Louisiana, including all locations within Jefferson, Orleans, Plaquemines, and St. Bernard Parishes

Newport, Rhode Island, including all locations within Newport County

Nome, Alaska

Oakland, California, including all locations within Alameda, Contra Costa, and Marin Counties

Ocean City, Maryland, including all locations within Worcester County

Philadelphia, Pennsylvania, including all locations within Montgomery and Philadelphia Counties

Phoenix, Arizona

Pittsburgh, Pennsylvania

Portland, Oregon

Princeton, New Jersey, including all locations within Mercer County

Salt Lake City, Utah

San Antonio, Texas

San Diego, California, including all locations within San Diego County

San Francisco, California, including all locations within San Francisco County

San Mateo, California, including all locations within San Mateo County

Santa Barbara, California, including all locations within Santa Barbara County

Santa Cruz, California, including all locations within Santa Cruz County

Seattle, Washington, including all locations within King County

South Padre Island, Texas

Stamford, Connecticut

St. Louis, Missouri

Sun Valley, Idaho, including all locations within Blaine County

Tampa, Florida

Tom's River, New Jersey, including all locations within Ocean County

Tuscon, Arizona

Vail, Colorado, including all locations within Eagle County

Wailea, Maui, Hawaii

White Plains, New York, including all locations within Westchester County

All cities in countries located outside the borders of the United States

Out-Of-State, Special Designated High-Cost Geographic Areas

Washington D.C., including the cities of Alexandria, Fairfax, and Falls Church, the counties of Arlington, Fairfax and Loudon in Virginia, and the counties of Montgomery and Prince Georges in Maryland

New York, New York, including all locations within the counties of Nassau and Suffolk

State agencies may request the Director of Accounts and Reports to conduct a study of subsistence costs in any area not designated as a high-cost area. If the study findings of an area justify inclusion, the Director of Accounts and Reports may recommend to the Secretary of Administration that the area be added to the list of high-cost geographic areas. If the Secretary approves the addition of that area, subsistence payments for travel to the area may be made at the rate designated for high-cost geographic areas.

Actual Conference Lodging Reimbursement

The agency head must be provided with conference materials indicating that the conference will be held at or in connection with a lodging establishment with rates exceeding both the applicable lodging expense limitation established under K.A.R. 1-16-18 and the exception provided in K.S.A. 75-3207a(e). This exception allows the lodging rate to be exceeded by the lesser of either: (1) an additional 50% of the applicable lodging expense limitation, or (2) the actual lodging expense incurred.

K.A.R. 1-16-18a(e) has been amended to allow an agency to request to pay or reimburse actual lodging expenses when an employee is required or authorized to attend a conference, and the lodging rate exceeds the applicable lodging expense limitation (including the additional 50%). The term "conference" means any seminar, association meeting, clinic, colloquium, convention, symposium, or similar gathering that is attended by a state employee in pursuit of a goal, obligation, function, or duty imposed upon a state agency or performed on behalf of a state agency.

Before the date of travel, the agency should submit an original and one photocopy of Form DA-28, "Request for Actual Conference Lodging" to the Director of Accounts and Reports. The request must include the name of the conference, the dates of the conference, the location of the conference, and the name or names of the employees traveling to the conference. The agency head must sign the form to confirm that the conference lodging rates exceed the applicable lodging expense limitation. The requests will be reviewed for completeness and the Director of Accounts and Reports' signature will be affixed, and the original copy returned to the agency.

When the payment voucher is submitted for lodging, the original DA-28 must be attached to the payment voucher.

The reimbursement or direct payment of actual lodging expenses shall be effective for the approved conference and shall be applicable only to the state employee or employees attending the conference. Meal allowance will be reimbursed at the regular meal allowance rate based on the location of the conference.

The provision to pay actual conference lodging replaces the temporary high-cost geographic area designation approval process. The date on which expenses are incurred determines the appropriate approval process.

A copy of Form DA-28 is attached to this circular. The agency should make sufficient copies of this form to meet their needs, or access the form at www.ink.org/public/da/ar.

SAM:JR

Attachment

| INFORMATIONAL CIRCULAR NO. 99-A-004 |

|---|

| DATE: | June 18, 1998 | ||

|---|---|---|---|

| SUBJECT: | Travel Policy Changes | ||

| EFFECTIVE DATE: | July 1, 1998 | ||

| A & R CONTACT: | Audit Services Team - | Jo Ann Remp | (785) 296-2277 |

| Randy Kennedy | (785) 296-2125 | ||

| Leroy Charbonneau | (785) 296-2255 | ||

| Shirley Gilchrist | (785) 296-2882 | ||

| APPROVAL: | |||

| SUMMARY: | This circular contains miscellaneous changes to state travel policy effective July 1, 1998, as recommended by the Travel Task Force. | ||

|

|

|||

State travel reimbursement policies and procedures are often thought to be cumbersome and some are perhaps outdated. As I have visited with agencies, this has been brought to my attention on numerous occasions. There is a need to strike a balance between stewardship of tax dollars by maintaining some controls over these reimbursements and the common sense of the rules regarding these reimbursements. A task force, composed of representatives from several state agencies and from the Department of Administration, was formed to examine the travel issues.

Based on the recommendations of this task force, and the subsequent approval of the Secretary of Administration, the following policy changes regarding travel will be effective for travel occurring on or after July 1, 1998. Please note that these changes are in addition to those previously outlined in Informational Circular 99-A-002 (method to calculate maximum lodging reimbursement), and 99-A- 003 (revised high-cost listing, and conference lodging).

Border City Designation:

In accordance with K.A.R. 1-16-18(3), the director of accounts and reports may designate any city in a state bordering or near Kansas as a "border city" and reimburse meal allowance and lodging at in-state rates. This designation is subject to the approval of the secretary of administration. Pursuant to this approval, the border city designation has been expanded to include all locations within 200 miles of the Kansas borders. An updated border city listing is attached to this informational circular. Informational Circular No. 99-A-004 June 18, 1998 Page 2

KTAG/Turnpike reimbursement policies:

With the implementation of KTAG, receipt requirements are no longer appropriate, or practical, in all cases. Therefore, the responsibility for accurate turnpike toll claims, and whether receipts are required for reimbursement is delegated to the agencies.

Local Transportation Receipts Not Required:

Receipt requirements for local transportation have historically been determined based on what the company providing the service chooses to call their business. For example, a shuttle in Seattle might be the equivalent of a taxi in Houston. Often when travelers ask for a receipt for local transportation, they are given a "blank" receipt with the driver's signature or the company's rubber stamp. The traveler completes the receipt by filling in the amount of the fare. Since the traveler often completes these receipts rather than the driver, and the traveler is ultimately responsible for claiming only true and actual expenses, the receipt requirement for local transportation will be eliminated. This is intended to eliminate confusion for the traveler regarding receipt requirements for local transportation.

Approvals required for Justification for Rental Car:

Current policy requires a separate justification be submitted with the payment voucher when an employee rents a vehicle at the travel destination. Effective July 1, 1998, the requirement for separate justification for rental cars will be delegated to the agency. The agency will be responsible for approving the use of a rental vehicle, and the separate justification will no longer be an audit requirement for the payment voucher. We recommend that the approval for the rental car be incorporated in the agency's travel approval process.

Airfare in lieu of mileage calculation - what should be used as the "airfare" comparison rate?:

Agencies are unclear about the appropriate airfare rate to use when reimbursing an employee driving a privately owned vehicle rather than using the fastest public transportation. The State Travel Center has agreed to provide written quotes for airfare upon request. Comparisons should be made based on the date the out-of-state travel request is signed.

Non itemized motel receipts / Lowest single rate available:

Division of Accounts and Reports policy is to reimburse travelers for single rate lodging only. Unless information included on the lodging receipt indicates that other than the single rate is claimed or that charges in addition to room and taxes are included in the lodging claim, the receipt provided by the lodging establishment is sufficient for reimbursement.

Express checkout:

Employees using express checkout at lodging establishments do not always have a receipt marked "paid" at the time the reimbursement request is submitted. The Division of Accounts and Reports policy is that provided the dates of the stay, the room rate, and total charges are in agreement, the receipt does not have to indicate "paid".

State employees sharing rooms:

It has been a long-standing practice that employees may not pay the travel expenses of another employee. Therefore, if two employees share a hotel room, an interpretation can be made that the cost must be split at the lodging establishment, and each person pay their portion and receive a receipt from the lodging establishment.

While employees are not required to share lodging accommodations with other state employee when traveling, we will no longer require separate receipts from the lodging establishment showing that each employee paid a portion of the room charge. When employees choose to share a room, one employee may claim the entire room charge. However, the two payment vouchers must continue to be cross-referenced.

Reduced Meal Allowance for Meals Provided at No Cost to the Employee:

K.A.R. 1-16-18(d) provides that "if the cost of meals is included within the cost of registration fees or other fees and charges paid by the agency or supplied without cost by another party, the meal expenses shall be reduced . . ." in accordance with the meal reduction schedule in Informational Circular 99-A-002. This policy will be clarified in paragraph 4301 of the Employee Travel Expense Reimbursement Handbook to state that meal allowance should be reduced for complimentary breakfasts provided to employees at lodging establishments, excluding light "Continental" breakfasts.

These policy updates will be reflected in the Employee Travel Expense Reimbursement Handbook available at www.ink.org/public/da/ar. The current Travel Handbook (9" x 6") will no longer be printed and made available to state agencies in its current format. We are exploring cost-effective options for providing this information to you. One copy of this handbook (as printed from the Internet) will be mailed to each state agency when revisions have been completed.

SAM:JR

Attachment: Approved Border Cities (.pdf)

| INFORMATIONAL CIRCULAR NO. 99-A-005 | (Supersedes 98-A-004) |

|---|

| DATE: | August 5, 1998 | ||

|---|---|---|---|

| SUBJECT: | Budgetary Worksheet Reports | ||

| EFFECTIVE DATE: | Immediate | ||

| A & R CONTACT: | Payroll Services | (785) 296-3146 | |

| APPROVAL: | |||

| SUMMARY: | Transmittal of budget worksheet reports for preparation of fiscal year 2000 budget. | ||

|

|

|||

Enclosed are three budget worksheet reports prepared from the records of the Division of Accounts and Reports. A brief explanation of these reports follows.

The budget worksheets have a category of expenditures listed as an informational total titled "Non-reportable Expenditures". Non-reportable expenditures have been defined by the Division of the Budget as expenditures which represent duplication within an agency's budget. The following expenditures shown on the DA-406 budget worksheet, if made from other than the State General Fund (1000), are classified as non-reportable.

5150 -- Local City-County Sales Tax Payments

5170 -- State Aid to Other State Agencies

5180 -- Local City-County Transient Guest Tax Payments

All -- 7XXX Primary Classification Object Codes

The first two enclosed reports (DA-406 and DA-410 worksheets) contain budgetary expenditures for fiscal year 1998 classified by program and by object of expenditure. These reports can be used by the agency in preparing the "Expenditures" form (DA-406) and the "Plan for Financing" form (DA-410) for submission to the Division of the Budget, as part of the fiscal year 2000 budget. The third report (DA-404 worksheet) can be used in preparing the "Resource Estimate by Fund" (form DA-404) for the fiscal year 2000 budget.

The expenditures shown in the DA-406 and DA-410 worksheet reports conform to the definition of expenditures used for budget purposes; i.e., "all expenses, liquidated and unliquidated encumbrances, that were charged against an agency's funds during the particular fiscal year regardless of the fiscal year in which cash disbursements for these expenses were made". Expenditures reported for fiscal year 1998 include the outstanding encumbrances at June 30,1998, reported on your "List(s) of Outstanding Obligations" (form DA-118), printers requisitions,unpaid purchase orders, contract cover sheets, as well as the actual cash disbursements charged to the fiscal year. The combination of actual cash expenditures and unpaid encumbrances at June 30 represents the total budgetary expenditures.

Reappropriations of savings was authorized by the 1998 legislature. These Kansas Savings Incentive Program (KSIP) reappropriations are reflected as separate summary sub-accounts in the Budget worksheets for both appropriated and special Revenue funds.

If errors in program or object classification have been made in either cash expenditures or the coding of outstanding encumbrances, it will be necessary for the agency to correct those errors prior to preparing fiscal year 1998 expenditure data for inclusion on all of the forms (DA-402, DA-404, DA-406, DA-410 and DA-412) of the fiscal year 2000 budget submission.

____________________________

Shirley Moses, Director

Division of Accounts and Reports

______________________________

Mr. Duane A. Goossen, Director

Division of the Budget

SAM:RW:lmm

The explanation for appropriations made from the State General Fund (1000), State Budget Stabilization Fund (2295), Kansas Educational Building Fund (8001), State Institutions Building Fund (8100), Kansas Special Capital Improvements Fund (8110), and the Correctional Institutions Building Fund (8600) follows:

| Description | Explanation |

|---|---|

| Legislative Appropriation (Original Appropriation and Revisions) | Amount includes original and supplemental legislative appropriations. |

| Reappropriation | Amount of prior year appropriation balance reappropriated and authorized for expenditure in the current year. |

| Limited Reappropriation (Reserves) | Amount of prior year balance reappropriated but not authorized for expenditure in the current year. |

| Transfers | Amount of appropriation transferred into or out of the account by authorization of the Legislature or executive directives. |

| Total Available | Total of the items cited above including Limited Reappropriation amount. |

| Less - Lapses (Reversions) | Amount of appropriation lapsed for the fiscal year. This is the reversions amount in STARS. |

| Less - Balances Forward | Amount of appropriation balance reappropriated including any limited reappropriation balance. |

| Total Expenditures | Total budgetary expenditures for the fiscal year. This includes both cash expenditures and encumbrances outstanding at year-end. |

The explanation of items applicable to agency Special Revenue Funds follows:

| Description | Explanation |

|---|---|

| Reappropriation | Amount of carryover unencumbered cash balance available in the fund at beginning of fiscal year. |

| Adjustments to Fund Balance | Amount of outlawed warrants, residual equity transfers for outlawed warrants, and residual equity transfers used in closing out certain funds. |

| Net Receipts Revenue Sub-Object XXXX Revenue Sub-Object XXXX Total Net Receipts |

Receipt amounts by detailed revenue sub-object code credited to the fund during the fiscal year, and the total of all receipts to the fund. |

| Total Available | Total cash resources available in the Special Revenue Fund from carryover balances and total fiscal year receipts. |

| Less Balance Forward | Amount of unencumbered balance in Special Revenue Fund at end of fiscal year carried forward to the next fiscal year. |

| Total Expenditures | Total of cash expenditures plus encumbrances for a specific fiscal year account. |

| Expenditure Limitation | Represents the limitation on budgetary expenditures of the fund for the fiscal year. For the current fiscal year, any amount authorized by the State Finance Council effective July 1 is included. Starred amounts represent unlimited limitations for some budget units within the fund. |

| INFORMATIONAL CIRCULAR NO. 99-A-006 |

|---|

| DATE: | July 31, 1998 | ||

|---|---|---|---|

| SUBJECT: | Official 1998 Kansas Distance Chart | ||

| EFFECTIVE DATE: | September 1, 1998 | ||

| A & R CONTACT: | Audit Services Team - | Randy Kennedy | (785) 296-2125 |

| Leroy Charbonneau | (785) 296-2255 | ||

| Shirley Gilchrist | (785) 296-2882 | ||

| Jo Ann Remp | (785) 296-2277 | ||

| APPROVAL: | |||

| SUMMARY: | The Kansas Department of Transportation (KDOT) has issued a revised Official 1998 Kansas Distance Chart. Reimbursement to state employees is based on the distances shown on this chart. | ||

|

|

|||

K.A.R. 1-17-11 states that "Information and maps of the department of transportation shall be used in verifying mileage as reported or claimed by the traveler." We have been notified that KDOT has issued a revised Official 1998 Kansas Distance Chart. As noted on the chart, all distances were calculated along the shortest routes using the State Highway System and/or the Kansas Turnpike. Agencies should pay particular attention to changes in distance for destinations along the Kansas Turnpike. Two of these changes include the official distance between Topeka and Lawrence is now 28 miles on the 1998 chart, and the distance between Topeka and Wichita is 138 miles.

The Division of Accounts and Reports will begin reviewing payments based on this revised distance chart for all travel on or after September 1, 1998.

Copies of the revised Distance Chart may be ordered by contacting the Kansas Department of Transportation, Bureau of Transportation Planning, Room 830, DSOB, Topeka, Kansas 66612, telephone (785) 296-3841. Prepayment is required. The current price is $0.50 per copy.

SAM:JR

| INFORMATIONAL CIRCULAR NO. 99-A-007 |

|---|

| DATE: | September 1, 1998 | ||

|---|---|---|---|

| SUBJECT: | Employee Travel Expense Reimbursement Handbook and Employee Travel ExpenseReimbursement Summary | ||

| EFFECTIVE DATE: | September 1, 1998 | ||

| A & R CONTACT: | Audit Services Team - | Randy Kennedy | (785) 296-2125 |

| Leroy Charbonneau | (785) 296-2255 | ||

| Shirley Gilchrist | (785) 296-2882 | ||

| Jo Ann Remp | (785) 296-2277 | ||

| APPROVAL: | |||

| SUMMARY: | Distribute information regarding the Employee Travel Expense Reimbursement Handbook and Employee Travel Expense Reimbursement Summary | ||

|

|

|||

We have completed the revisions to the Employee Travel Expense Reimbursement Handbook. If your agency receives Informational Circulars through e-mail, you may go to our Internet site at www.ink.org/public/da/ar, to the employee reimbursement section and print a copy of the handbook and the related DA forms for which completion instructions are listed in Section 6000. If you are an agency who routinely receives a printed copy of Informational Circulars, the handbook and forms are attached to this circular.

All recipients of this circular will find the brochure, Employee Travel Expense Reimbursement Summary, attached. This document summarizes travel reimbursement rates and basic travel guidelines. We intend that this document be copied (front to back) and distributed as a "tri-fold" brochure to employees who have a need for this information. This brochure is also available at our Internet site.

SAM:RK

Attachment

| INFORMATIONAL CIRCULAR NO. 99-A-008 |

|---|

| DATE: | September 18, 1998 | ||

|---|---|---|---|

| SUBJECT: | STARS Direct Deposit Payments | ||

| EFFECTIVE DATE: | September 18, 1998 | ||

| A & R CONTACT: | Payments: | Audit Services Team - | Randy Kennedy (785) 296-2125 |

| Leroy Charbonneau (785) 296-2255 | |||

| Shirley Gilchrist (785) 296-2882 | |||

| Jo Ann Remp (785) 296-2277 | |||

| Enrollment: | Financial Integrity Team - | Nickie Roberts (785) 296-7917 | |

| APPROVAL: | |||

| SUMMARY: | Effective September 18, 1998, financial institutions are required to provide payment-related information associated with electronic deposit items to vendors. | ||

|

|

|||

Since the implementation of electronic deposit payment capabilities in STARS, we have used the "CTX" (Corporate Trade Exchange) format, and transmitted addenda records containing the same invoice and description information which agencies enter on the funding lines of payment vouchers. Although this information was transmitted through the banking channels, very little of this addenda information ever reached the vendor. This often meant that the agency had to continue to forward remittance information to the vendor to ensure that the payment was posted to the appropriate account or risk that the payment not be credited to the appropriate account(s).

Effective September 18, 1998, the National Automated Clearing House Association (NACHA) requires that all Automated Clearing House (ACH) receiving institutions (the financial institution receiving the electronic deposit) be capable of forwarding information contained in addenda records attached to the corporate ACH items (i.e., our "CTX" records) to receivers (your vendor), at the receivers' request, within two banking days of receipt. This means vendors receiving STARS ACH (electronic) payments can request from their financial institution the same information that is printed on a paper warrant and stub. This includes the agency number, voucher number, invoice number field, and invoice description field as keyed on the voucher.

In order to transmit payments by ACH, an "X" must be in the payment indicator field of the voucher and the vendor must already be shown as prenoted in the vendor file. Each funding line has a 14 character "invoice number" field, and a 30 character "invoice description field". These two fields can be used transmit whatever the vendor requires to identify the payment.

In conjunction with this NACHA rule change, we would like to encourage your agency to encourage your vendors (including employees) to take advantage of ACH payments whenever possible rather than continuing to use paper warrants. Vendors not currently established in the STARS Vendor File with the necessary banking information may become ACH capable by completing Form DA-130,Authorization for Electronic Deposit of Vendor Payment. This form may be found at our Internet site under General Accounting Services.

SAM:JR

| INFORMATIONAL CIRCULAR NO. 99-A-009 | (Supersedes Amends 98-P-21) |

|---|

| DATE: | December 18, 1998 | ||

|---|---|---|---|

| SUBJECT: | IRS Notice 97-73 - Returns Relating to Higher Education Tuition and Related Expenses. Amendment to Informational Circular 98-P-21. | ||

| EFFECTIVE DATE: | December 18, 1998 | ||

| A & R CONTACT: | Don Beck, Central Accounting Services | (785) 296-7291 | |

| APPROVAL: | |||

| SUMMARY: | Amendment to Informational Circular 98-P-21 regarding Regents reporting responsibilities for 1998 under Section 6050S of the Internal Revenue Code. | ||

|

|

|||

Informational Circular 98-P-21 notified each Board of Regents' institution of its responsibility for determining the applicability of the requirements of Internal Revenue Code Section 6050S to their institution and for submitting any required forms/reports to the Internal Revenue Service.

Since Regents' institutions will be filing 1098-T forms in conjunction with the requirements of Section 6050S, the 1098-T forms should be filed independent of the Division of Accounts and Reports. Each Regents' institution will be required to obtain their own Federal IdentificationNumber (FIN) for filing with the Internal Revenue Service. The State of Kansas federal identification number 48-6029925 should not be used.

SAM:db

| INFORMATIONAL CIRCULAR NO. 99-A-010 | (Supersedes 99-a-001) |

|---|

| DATE: | March 5, 1999 | ||

|---|---|---|---|

| SUBJECT: | Proposed Private Vehicle Mileage | ||

| EFFECTIVE DATE: | April 1, 1999 | ||

| A & R CONTACT: | Audit Service Team | ||

| Randy Kennedy | (785) 296-2125 | ||

| Leroy Charbonneau | (785) 296-2255 | ||

| Shirley Gilchrist | (785) 296-2882 | ||

| Mark Handshy | (785) 296-7021 | ||

| Jo Ann Remp | (785) 296-2277 | ||

| APPROVAL: | |||

| SUMMARY: | Proposed Private Vehicle Mileage Reimbursement Rates Effective April 1, 1999 | ||

|

|

|||

This is advance notice that temporary regulations have been proposed to amend K.A.R. 1-18-1a to decrease the reimbursement rates for privately owned vehicles for travel taking place on or after April 1, 1999. These proposed rate changes are due to changes in the maximum mileage reimbursement allowed by the IRS. Once the temporary regulations are enacted another Informational Circular will be issued confirming the new rates. The proposed amended rates are:

| 15¢ | per mile for privately owned motorcycle |

|---|---|

| 31¢ | per mile for privately owned automobile |

| 43¢ | per mile for privately owned airplane |

| 43¢ | per mile for privately owned specially equipped vehicle for the physically disabled |

Please note that the provision to reimburse mileage at the central motor pool rate for compact cars remains in effect for any state employee choosing to use a privately owned automobile, when a state-owned or leased vehicle is available for use. For FY 1999, this rate is 18¢ per mile as established by Central Motor Pool. The complete schedule of motor pool rates has previously been distributed to all state agencies in a memorandum from the Central Motor Pool Director.

SAM:rk

| INFORMATIONAL CIRCULAR NO. 99-A-011 | (Supersedes 99-a-010) |

|---|

| DATE: | March 22, 1999 | ||

|---|---|---|---|

| SUBJECT: | Private Vehicle Mileage | ||

| EFFECTIVE DATE: | April 1, 1999 | ||

| A & R CONTACT: | Audit Service Team | ||

| Randy Kennedy | (785) 296-2125 | ||

| Leroy Charbonneau | (785) 296-2255 | ||

| Shirley Gilchrist | (785) 296-2882 | ||

| Mark Handshy | (785) 296-7021 | ||

| Jo Ann Remp | (785) 296-2277 | ||

| APPROVAL: | |||

| SUMMARY: | Private Vehicle Mileage Reimbursement Rates Effective April 1, 1999 | ||

|

|

|||

Temporary regulations have been enacted to amend K.A.R. 1-18-1a to decrease the reimbursement rates for privately owned vehicles for travel taking place on or after April 1, 1999. Permanent regulations will be enacted prior to the temporary regulations expiring. These rate changes are due to changes in the maximum mileage reimbursement allowed by the IRS. The amended rates are:

| 15¢ | per mile for privately owned motorcycle |

|---|---|

| 31¢ | per mile for privately owned automobile |

| 43¢ | per mile for privately owned airplane |

| 43¢ | per mile for privately owned specially equipped vehicle for the physically disabled (Examples of specially equipped vehicles include, but are not limited to, those equipped with hand controls or lift devices. Other situations may be evaluated on a case-by-case basis if you are uncertain about the applicability of this rate.) |

Please note that the provision to reimburse mileage at the central motor pool rate for compact cars remains in effect for any state employee choosing to use a privately owned automobile, when a state-owned or leased vehicle is available for use. For FY 1999, this rate is 18¢ per mile as established by Central Motor Pool. The complete schedule of motor pool rates has previously been distributed to all state agencies in a memorandum from the Central Motor Pool Director.

SAM:rk

| INFORMATIONAL CIRCULAR NO. 99-A-012 | (Supersedes 99-a-007) |

|---|

| DATE: | April 9, 1999 | ||

|---|---|---|---|

| SUBJECT: | Revised Reference Materials Pertaining to Employee Travel Reimbursement | ||

| EFFECTIVE DATE: | April 1, 1999 | ||

| A & R CONTACT: | Audit Service Team | ||

| Randy Kennedy | (785) 296-2125 | ||

| Leroy Charbonneau | (785) 296-2255 | ||

| Shirley Gilchrist | (785) 296-2882 | ||

| Mark Handshy | (785) 296-7021 | ||

| Jo Ann Remp | (785) 296-2277 | ||

| APPROVAL: | |||

| SUMMARY: | Notification that the Employee Travel Expense Reimbursement Summary (travel tri-fold), On-line Employee Travel Expense Reimbursement Handbook, and Policy and Procedure Manual Filing 3,903 have been revised to reflect the amended privately owned vehicle mileage reimbursement rates which were effective April 1, 1999. | ||

|

|

|||

The Employee Travel Expense Reimbursement Summary (travel tri-fold) has been revised to reflect the amended privately owned vehicle mileage reimbursement rates previously communicated to you in Informational Circular 99-A-011. This document is available at http://www.da.ks.gov/ar/employee/travel/trifold.pdf. You may copy this document and distribute to your employees as you choose.

The On-line Employee Travel Expense Reimbursement Handbook and Policy and Procedure Manual Filing 3,903 have also been revised to reflect these amended rates.

You may access these documents at http://www.da.ks.gov/ar/employee/travel/travbk.htm and http://www.da.ks.gov/ar/ppm/ppm03903.htm and distribute throughout your organization as you choose.

SAM:JR

| INFORMATIONAL CIRCULAR NO. 99-A-013 |

|---|

| DATE: | April 12, 1999 | |

|---|---|---|

| SUBJECT: | Deletion of Expenditure Sub-object Codes 4XX9 | |

| EFFECTIVE DATE: | June 30, 1999 | |

| A & R CONTACT: | Pam Karns, Financial Integrity Team | (785) 296-2660 |

| APPROVAL: | ||

| SUMMARY: | Deletion of expenditure sub-objects 4XX9. These items will no longer be coded as capital outlay purchases, but will be classified as the appropriate commodity sub-object. | |

|

|

||

In past years, capital outlay purchases were classified under a dual sub-object code system which was determined by the cost of the item being purchased. Items with a useful life expectancy of one year, or more, with a cost of $75 ($20 for books), but less than $500 were classified as sub-object 4XX9 (non-inventory) and items with a useful life expectancy of one year, or more, with a cost of $500, or more, were classified as sub-object 4XX0 (inventory). To eliminate this inefficiency in coding, it has been determined that only those items with a useful life expectancy of one year, or more, with a cost of $500 (including books), or more, should be classified as "capital outlay" and maintained on inventory.

Effective with fiscal year 2000 business, the expenditure sub-object series 4XX9 will be eliminated and the definition of capital outlay will be amended to define capital outlay/inventory as any item with a useful life expectancy of one year, or more, and with a cost of $500, or more. Items purchased as fiscal year 2000 business which were previously classified as "non-inventory capital outlay" and coded 4XX9 will instead be classified as the appropriate commodity sub-object. When submitting encumbered items for DA-118 transactions for fiscal year 1999, please use the revised coding policy which eliminates the 4XX9 expenditure sub-object codes.

The following expenditure sub-object codes will be closed effective June 30, 1999. Please review all encumbrance documents that extend beyond fiscal year 1999 for this change in expenditure sub-object coding. This will expedite the processing of these encumbrance documents and help reduce the number of delays experienced during fiscal year closing.

4019 Agricultural Equipment and Machinery - Non - Inventory

4029 Household, Laundry and Kitchen Equipment and Furniture - Non - Inventory

4039 Office Furniture, Fixtures and Equipment - Non - Inventory

4049 Professional and Scientific Equipment - Non - Inventory

4079 Road and Highway Machinery and Equipment (Agencies 276, 710) - Non - Inventory

4089 Shop and Plant Maintenance Equipment - Non - Inventory

4099 Other Equipment, Machinery, Furniture and Fixtures - Non - Inventory

4109 Livestock - Non - Inventory

4119 Books and Library Material - Non - Inventory

4129 Reprographic Equipment - Non - Inventory

4139 Microcomputer Systems and Support Equipment - Non - Inventory

4169 Information Processing Equipment - Non - Inventory

4189 Computer Systems, Information Processing or Microcomputer Systems Software - Non - Inventory

4619 Telecommunications Termination Equipment - Non - Inventory

4629 Telecommunications Switching Equipment - Non - Inventory

4639 Telecommunications Transmission Equipment - Non - Inventory

4649 Radio (Portable) Equipment - Non - Inventory

4659 Radio (Fixed) Equipment - Non - Inventory

4669 Data Communications Equipment - Non - Inventory

Please note these deletions in your copy of the Uniform Expenditure Classification of Expenditure Sub-object Codes filing (P.P.M. No. 7,002). These deletions should be reflected in a future revision of this filing.

PK:RA:lmm

| INFORMATIONAL CIRCULAR NO. 99-A-014 | (Supersedes 98-A-015) |

|---|

| DATE: | April 14, 1999 | ||

|---|---|---|---|

| SUBJECT: | Closing of Fiscal Year 1999 and Opening of Fiscal Year 2000 | ||

| EFFECTIVE DATE: | Immediately | ||

| A & R CONTACT: | Central Accounting Services Section | (785) 296-8083 | |

| APPROVAL: | |||

| SUMMARY: | Schedule of Accounting Events Relative to Fiscal Year Closing | ||

|

|

|||

It is time to close another fiscal year and we are asking for your cooperation to help ensure a successful and timely closing of FY 1999 and opening of FY 2000. Information concerning closing is contained in the Division of Accounts and Reports Policy and Procedure Manual filing no. 14,002 which is also in the General Accounting Services section of the Division of Accounts and Reports web site at: http://www.da.ks.gov/ar/ppm/ppm14002.htm.

K.S.A. 75-3002 establishes the state's fiscal year as commencing on the first day of July in each year and closing on the thirtieth day of June of the succeeding year. However, to allow state agencies time to process as much old year business as possible, the old year records remain open through the second Monday of July (PPM No. 14,002) unless that date results in less than eight business days, in which case, the closing date will be set to allow eight working days to process the old year transactions. During this period the Statewide Accounting and Reporting System (STARS) processes old and new fiscal year business concurrently.

During the concurrent processing period, FY 1999 documents receive a higher processing priority than do FY 2000 documents. This, and the large volume of last minute old year business received for processing, may cause delays in the processing of FY 2000 business. There is a period (usually three or four days) after the third Monday in July in which no daily transactions are processed. During this period, total effort is directed to processing transactions necessary to complete the transition from FY 1999 to FY 2000. These delays are an inherent part of the fiscal year closing process.

Your understanding of the unique circumstances encountered during the fiscal year transition period will help to reduce the number of delays experienced during fiscal year closing. Obviously, the workload both at your agency and the Division of Accounts and Reports is greatly increased during this period; therefore, following certain guidelines will result in a smoother flow of transactions.

FY 1999 business should be processed in a timely manner both at the agency level and at the central level. This will relieve some delays caused by the multitude of last minute vouchers received by the Division of Accounts and Reports. Some degree of relief can also be realized by state agencies reviewing the May monthly reports and submitting necessary requests for corrections before June 30. This will significantly reduce the volume of last minute journal entries.

All transactions submitted during the concurrent processing period should be carefully reviewed for accurate and complete coding, authorized signature, sufficient unencumbered balances, and any potential errors that may require additional processing time. Transaction year 1999 and 2000 documents should be batched separately. During concurrent processing STARS batch sheets for FY 1999 transaction year should have a batch date of 06-30-99, an effective date of 06-30-99, and BFY of 1999. Keeping the exceptions to a minimum during this period will result in more efficient and timely processing of transactions.

During the concurrent processing period, special attention should be given by agencies to the unencumbered balances of those funds whose budget units are classified as "expenditure only". To make "carry forward" balances available as of July 1 for use by state agencies, STARS has been programmed to allow new year transactions charged to "expenditure only" accounts to edit against fund-level (both FY 1999 and FY 2000) receipts. However, during this period, FY 1999 transactions only edit against FY 1999 receipts.

During the concurrent period, those state agencies having accounts structured as "receipt and expenditure" must ensure that FY 2000 receipts are available to cover FY 2000 expenditures from budget units classified as both receipt and expenditure. The available cash in prior fiscal year receipt and expenditure budget units will not be available to fund FY 2000 expenditures until FY 1999 is closed and balances carried forward.

During the concurrent transition period, personnel at all levels are subjected to increased workloads and pressures. Errors will be resolved in the most efficient and timely manner possible. Emergency situations will be reviewed and acted upon as soon as possible. Transactions categorized as emergency payments should be batched separately and sent to the attention of Jerry Serk, Central Accounting Services Section, Division of Accounts and Reports, 900 S.W. Jackson Street, Room 351-S, Topeka, Kansas, 66612-1248.

Every effort must be made to ensure that payments of legal obligations to vendors are not delayed. With your proactive support and assistance, we look forward to a timely year-end transition.

A schedule of events concerning the closing of Fiscal Year 1999 and the opening of Fiscal Year 2000 has been prepared to identify certain functions and events of mutual interest to state agencies and the Division of Accounts and Reports. These items and dates are as follows:

| DATE | ITEM |

|---|---|

| April 16 | Letter Advising Agencies to Prepare Real Estate Encumbrance Renewals (Affected Agencies Only) |

| May 3 | Letter Requesting Agencies to Review Outstanding Encumbrances |

| May 17 | Letter to Agencies Transmitting List of Outstanding Obligations (DA-118) Instructions |

| May 21 | Year-End Closing Information at ASTRA meeting |

| June 1 | Annual Review of Housing, Food Service and Other Employee Maintenance Rates (DA 171) |

| June 16 | Fiscal Year 2000 Valid Funds Tape and Valid PCA Tape Sent to State Treasurer |

| June 17 | Preliminary Fiscal Year 2000 Central Chart of Accounts Mailed to State Agencies |

| June 18 | Informational Circular to All State Agencies Regarding Fiscal Year Rate Changes in Payroll Deductions and Contributions |

| June 22 | Review Any Outstanding Checks and Process Paycheck Reversals Prior to June 23, 1999, which is the Last Off -Cycle Payroll Charged To Fiscal Year 1999. Any Checks Issued in This Cycle Will Be Dated June 28, 1999 and Charged to Fiscal Year 1999 |

| June 28 | Updates to Payroll Position Pool Definitions for Fiscal Year 2000 Must be Entered into SHARP by 5:00 P.M. in Order to be Reflected in the Charges for Any Paychecks Resulting from the last Off-Cycle for the Period Ending June 12, 1999 (First Off-Cycle Payroll Charged to Fiscal Year 2000) |

| June 30 | Regents Establish Payroll Clearing Fund Indexes in STARS for Fiscal Year 2000 |

| July 1 | Fiscal Year 2000 Transactions Accepted for Processing: Also Commencement of Concurrent Processing Period for Final Fiscal Year 1999 Transactions

STARS open to all users for on-line transactions 8:00 AM - 12:00 PM; while we do not anticipate any processing problems due to Y2K, STARS will only be available to A&R staff prior to 8:00 AM; the first Fiscal Year 2000 processing cycle will begin at 12:00 PM in order to deal with any Y2K problems regarding this first Fiscal Year 2000 STARS Batch Cycle |

| July 2 | Updates to Payroll Position Pool Definitions for Fiscal Year 2000 Must be Entered into SHARP by 5:00 P.M. in Order to be Reflected in the Charges for the On-Cycle Paychecks Dated July 9, 1999 (First On-Cycle Paychecks Charged to Fiscal Year 2000) |

| July 8 | DA-35 Electronic Files (Prior Period Funding Payroll Adjustments) Must be Received by 5:00 P.M. |

| July 13 | State Treasurer Accepts Final Fiscal Year 1999 Receipts Vouchers from State Agencies up to 3:00 P.M. |

| July 13 | Central Accounting Services Section Accepts Final Expenditure and Encumbrance Batches from State Agencies for Fiscal Year 1999 Until 5:00 P.M. |

| July 13 | Agencies Entering STARS Payment Vouchers On-Line Must Have Final Documents for Fiscal Year 1999 Entered by 5:00 P.M. |

| July 14 | Agencies Entering Payment Vouchers On-Line in STARS With a June Effective Date Must Have Paper Documents into the Central Accounting Services Section by 12:00 Noon to Avoid Transactions Being Deleted from the System |

| July 15 | Agencies May Enter DA-118's On-Line Until 5:00 P.M. |

| July 16 | Agencies Entering DA-118's On-Line Must Have Paper Documents delivered to the Accounting Services Section By 12:00 Noon to Avoid Transactions Being Deleted from the System |

| July 20 | Final Processing of June 1999 Transactions Expected; End of Concurrent Processing (STARS will be open to Accounts and Reports Staff, only) |

| July 21 | Commencement of Processing for Monthly and Annual Reports and Statements; Also, Processing of Closing and Opening Entries and Preparation of Opening and Closing Transaction Statements |

| July 26 | June 1999 Monthly STARS Statements Expected to be Mailed to Agencies |

| July 26 | Resume Processing of July 1999 (Fiscal Year 2000) Transactions |

| July 29 | Fiscal Year 1999 Closing Statements and Fiscal Year 2000 Opening Statements Expected to be Mailed to Agencies |

| August 4 | DA-404, DA-406 and DA-410 Budget Worksheets Expected to be Distributed |

SAM:JS:aw

| INFORMATIONAL CIRCULAR NO. 99-A-015 | (Supersedes 1065 and 1267) |

|---|

| DATE: | June 7, 1999 | ||

|---|---|---|---|

| SUBJECT: | Journal Voucher Request Format and Journal Vouchers to Correct Expenditure and Receipt Documents | ||

| EFFECTIVE DATE: | June 7, 1999 | ||

| A & R CONTACT: | Audit Services Team | ||

| Randy Kennedy | (785) 296-2125 | ||

| Leroy Charbonneau | (785) 296-2255 | ||

| Shirley Gilchrist | (785) 296-2882 | ||

| Gina Reynoldson | |||

| APPROVAL: | |||

| SUMMARY: | Provide format for Journal Voucher Requests to adjust STARS payment and receipt documents (not including payroll). Provide information to prepare journal vouchers to accomplish corrections. | ||

|

|

|||

Any element of a payment voucher or receipt voucher may be corrected (if appropriate) by preparing either a Journal Voucher Request (form DA-35R) or by preparing a DA-35A, journal voucher (one or the other, not both). The first attachment is the Journal Voucher Request. Journal Voucher Requests are used to request that the Audit Services Team make a correction to a previous payment voucher or receipt voucher. The Audit Services Team will then make a journal voucher correction in STARS based on the request.

The second attachment is a blank DA-35A journal voucher form. The DA-35A can be used by the agency to prepare the correction to a previous payment or receipt. The completed DA-35A should be submitted to the Audit Services Team for approval and processing.

The forms will be available, either for printing or download at our Internet site, http://www.da.ks.gov/ar/. The DA-35A will be in EXCEL format and the DA-35R in WORD format.

Rules that apply to DA-35Rs and DA-35As:

- Prior fiscal year corrections to PCA, expenditure sub-object, or revenue sub-object will not be processed with one exception. Corrections for expenditure transactions that affect IRS 1099 reporting in the current calendar year will be processed.

- No object code correction for less than $50.00 may be processed except when IRS 1099 reporting is affected.

The IRS 1099 reportable expenditure sub-object codes as of June 7, 1999 are:

2130 2440 2700 2790 5280 5523 2140 2620 2710 2791 5291 5525 2310 2632 2720 2950 5510 5526 2320 2633 2730 2980 5512 5591 2330 2640 2740 5204 5513 5920 2340 2650 2750 5205 5515 5940 2360 2670 2760 5206 5516 5950 2370 2680 2770 5241 5520 5980 2390 2690 2780 5270 5522 7150 - Changes made that impact IRS 1099 reporting must be made during the calendar year of the payment. Transaction code 780 with a vendor number must be used. If the correction is not made in the same calendar year, then do not use transaction code 780 (use 783).

- Clearly identify interfunds (if correcting the receipt portion, list the paying agency and paying voucher number (not necessary with the SOKI3 vouchers: State of Kansas Interactive Internet Interfunds)), interfund vouchers processed via the SOKI3 system, and vouchers processed under the agency's delegated audit authority. When submitting a listing of multiple vouchers they should be grouped by type of document (i.e. requests for adjustments to delegated audit authority vouchers should be submitted together rather than intermixed with other types of vouchers).

- Encumbrance numbers should only be listed or used when a change needs to be made to the encumbrance (i.e. the encumbrance needs to be charged and was not).

- a. Agencies should submit an original and a copy of each Journal Voucher Request DA-35R (please staple these together). The Audit Services Team will return the copy indicating the journal voucher number assigned and the date it was submitted for processing. If a copy is not submitted with the original, then no copy will be returned to the agency.

b. The Audit Services Team will not return copies of DA-35A journal vouchers prepared by the agency (only the original should be submitted). The agency should be able to determine if the document processed in STARS using the document number the agency assigned. The Audit Services Team will notify the agency of any changes to the DA- 35A. - The DA-35R or DA-35A should only list the funding line affected by the desired change.

The balance of this circular applies to preparation of DA-35A's only.

Preparing the DA-35A Journal Voucher (see attached blank DA-35A)

The left most column (labeled "c/n to") of the DA-35A should contain the document number being corrected.

The current document number format is J2NNNXXX. NNN represents the agency number and XXX is a number assigned by the agency preparing the journal voucher.

In the explanation at the bottom indicate the purpose for the corrections and note if it is a payment voucher processed under the agency's delegated audit authority, an interfund, or an interfund processed in the SOKI3 system.

The next step is to reverse the original transaction by selecting the proper transaction code. Use the chart on the following page to determine the transaction code to use. First look at the column labeled "Original T/C" and locate the transaction code used when the document was processed, then select the corresponding transaction code in the column labeled "Correction T/C". Use the funding from the original document on this line of the DA-35A.

A reversal code of "R" is used to reverse the original line of funding for transaction codes in the 7XX series and 6XX series. However, the opposite is true when adjusting an encumbrance. To apply an expenditure against an encumbrance, an "R" should be used with transaction code 804 or 814. To restore an encumbrance (i.e. it was charged in error), the "R" should not be used.

To make the correcting entry determine the transaction code that should have been used with the transaction in the "Original T/C" column and select the corresponding transaction code in the column "Correction T/C". Put the corrected funding on this line of the DA-35A.

When using T/C 804 or 814 all funding elements including PCA, sub-object, and vendor number/sfx must match exactly to the encumbrance being adjusted regardless of how the voucher was paid. It is acceptable if the original voucher paid with a different PCA, sub-object or vendor number suffix than the encumbrance as long as they were appropriate to the payment.

| Original T/C | Correction T/C | Vendor Number | Comments |

|---|---|---|---|

| Receipts | |||

| 602 | 602 | no | |

| 603 | 603 | no | |

| 604 | 604 | no | |

| 605 | 605 | no | |

| 606 | 606 | no | |

| 631 | 631 | no | |

| 632 | 632 | no | |

| 633 | 633 | no | |

| 635 | 635 | no | |

| 636 | 636 | no | |

| 639 | 639 | no | |

| Expenditures | |||

| 699 | 792 | no | |

| 700 | 793 | no | |

| 702 | 791 | yes | |

| 703 | *783 | no | |

| 704 | *783 | no | |

| and 804 | yes | Use only if encumbrance needs to be adjusted | |

| 705 | *783 | no | |

| and 814 | yes | Use only if encumbrance needs to be adjusted | |

| 707 | 783 | no | |

| 717 | 781 | yes | |

| 718 | 782 | yes | |

| 723 | 784 | yes | |

| 731 | 783 | no | |

| and 814 | yes | Use only if encumbrance needs to be adjusted | |

| 732 | 783 | no | |

| and 804 | yes | Use only if encumbrance needs to be adjusted | |

| 733 | 783 | no | |

| 734 | 781 | yes | |

| 735 | 784 | yes | |

| 736 | 791 | yes | |

| *use 780 when changes to 1099 reporting are needed (vendor number required) | |||

The person completing the DA35A should affix their name in the appropriate block on the lower right of the DA-35A. There is also a second name block for another person at the agency to approve the DA-35A (optional). These names may be signed, printed or stamped.

Examples of DA-35A corrections (CY=current year, PY=prior year):

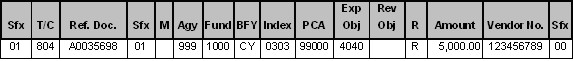

Correct funding and sub-object. The first line reverses the original expenditure and the second charges the correct funding. This format is also used for correcting encumbered payments where no adjustment is needed to the encumbrance.

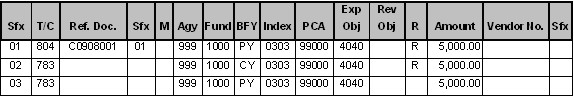

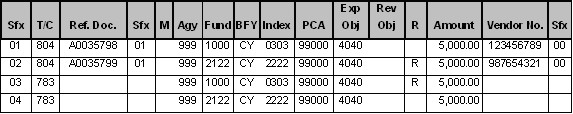

Apply a current year payment against a prior year encumbrance. The first line charges the encumbrance, the second line restores the current year funding as if the transaction had not occurred, and the third line charges the prior fiscal year.

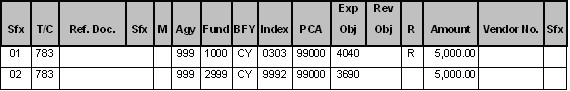

Reduce an interfund, which processed in excess of the amount due. When another agency is involved both agencies must approve the reduction.

Apply a payment against an encumbrance when the original payment was made unencumbered against the same funding and fiscal year. Note that if the encumbrance has a vendor number it is required on the journal voucher.

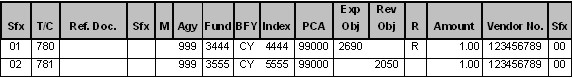

Correct the encumbrance and funding for an encumbered payment. The first line restores the encumbrance balance that was charged in error. The second line charges the correct encumbrance. The third line reverses the original funding. The fourth line charges the correct funding.

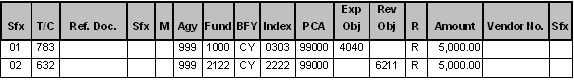

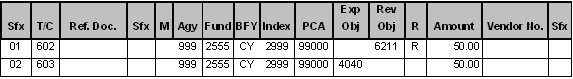

Correct a payment voucher from an expenditure to a reduction of revenue.

Correct a receipt from a revenue to a reduction of expenditure. This should only be used for refunds or recovery of overpayments.

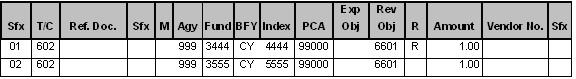

Correct funding on a prior year receipt. Corrections to prior year receipt funding are made in the current fiscal year using transfer sub-object codes. Sub-object code 6601 is always used regardless of the original sub-object code. The explanation on the DA-35A must state in which fiscal year the original receipt transaction processed.